Frequently Asked Questions

Everything you want to know about Smart Oak

ABOUT

Q. What is Smart Oak?

A. Smart Oak Corporation (www.smart oak.us) is the next generation multifamily real-estate investment company. Our mission is to buy, operate, refinance, and sell multifamily rental properties in the “Greater Oakland” area (Oakland, San Francisco, Alameda & Contra Costa counties).

Q. What market opportunity does Smart Oak have?

A. Every year, California invests billions of dollars into solving the state housing crisis. Local governments in California have received hundreds of millions each to rent, build, and improve their communities.

The Greater Oakland area provides us a unique opportunity to build a fast growing, highly profitable business, by investing in and operating multifamily rental properties in the area.

Q. How is Smart Oak organized?

A. Smart Oak Corporation is organized as C-corporation operating in California. In the future Smart Oak will be converted into a REIT to optimize shareholder returns.

Q. What are the unique advantages of Smart Oak?

A. Our unique advantages:

- Relationship with Oakland and Alameda County authorities and bureaus that would allow us to fill rental apartments with sponsored tenants, immediately after property acquisition

- Extensive knowledge of the Greater Oakland area and significant opportunities to find stressed properties for purchasing

- Access to cost-effective house repair services

- Relationship with banks and other entities, that would allow us to get the best financing deals

- Managerial and operational experience: we can work efficiently under pressure

- Prior real-estate investment experience with a substantial success track record

- Paralegal and business formation experiences, access to high quality real-estate legal firms and business developers

- Re-investing initially raised capital into sequential deals without turning to investors for additional funds

- Opportunity for investors to gain return from all the company’s projects while only making an initial investment

- Opportunity for investors to purchase additional shares while supply lasts

Q. How can I find more information about Smart Oak (business, assets, financials data)?

A. Please contact us at info@smartoak.us to request a corporate NDA and access to Smart Oak proprietary information.

Q. What are your prior success stories?

A. The Smart Oak team has been operating in the Greater Oakland Area since 2017. Our team owns private multifamily real estate properties producing over 20% net operational profit and achieving 100% market value increase.

Q. What is Smart Oak Governing Structure?

A. Smart Oak Corporation formed two boards: Board of Directors (BOD) and Board of Advisors (BOA).

FINANCIALS

Q . What are the financial goals for Smart Oak?

A. We call our financial goals “20/20”: 20% yearly rental profit and 20% yearly property market value increase.

Q. How fast does Smart Oak plan to achieve its financial goals?

A. By the end of 2025.

Q. Does Smart Oak have a detail financial model and how I can get it?

A. Please contact us at info@smart oak.us to request corporate NDA and access to Smart Oak proprietary informat ion.

Q. How much of the company’s profit do you plan to retain for future projects vs. how much will you pay as dividends to the company shareholders?

A. Dividends will be generated by cash flow produced from individual properties, while investments will be funded by the raised capital and funds received from re-financing and/or from the sale of asset s. We are planning to generate profit re-investing the same funds repeatedly through re-financing or selling.

Q. What is Smart Oak mortgage loan strategy?

A. Smart Oak mortgage has short-term and long-term mortgage loan strategies.

- Short term: We are planning to get a 30-year mortgage with 2.85-3 .5% interest.

- Long-term: Smart Oak is a female-founded and lead company, specializing in affordable multifamily real-estate development and investment. In 2021 the State of California approved an additional $15b in funding for resolving the housing crisis, and Smart Oak is exactly the type of company that a portion of this money is going towards. We are expecting to receive funding from the local government of Greater Oakland and from the State of California in form of grants, investments, and/or low-interest loans. This provides us a hedge against potential loan interest spikes starting summer 2022 and beyond.

OPERATION

Q. What is the Smart Oak Operational Model?

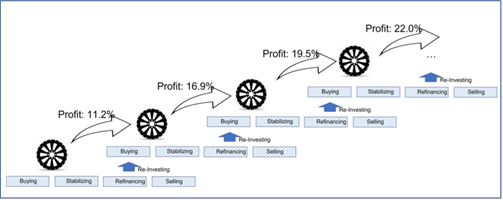

A. Smart Oak is operating using a proprietary “Real -Estat e Wheel” strategy to optimize financial returns The Company is:

- Buying properties with high stabilization potential;

- Stabilizing rent revenue through highly efficient, fast remodeling, and signing multi-year rent commitments with local government ;

- Refinancing company with 20-30% home value increase through an attractive 3-3.4% commercial loan;

- Re-Investing “freeing capital” in the next deal (buying additional properties);

- Selling properties at the maximum valuation.

Q. How would Smart Oak grow property value?

A. The main strategy consists of the following steps:

- Renting revenue optimization

- Efficient and creative use of property land and building’s spaces

- Creating stream revenue from other amenities

- Refinancing and re-investing freed capital into the next deal

The example below provides an illustration of such strategy.

- Let’s assume that we acquire 16 units multifamily property where 4 units are vacant and closed the deal for $1.2M with a 35% down payment of $420K.

- As soon as we rent 4 vacant units, we would increase property value to $2.1-2.6M . Refinancing this property will allow us to:

- free the original down payment ($420K);

- Get access to inexpensive additional capital and invest it in the next property acquisition.

- Upon refinance: the gross yearly rent gross revenue of the property is conservatively estimated as $300-320K. Yearly expenses are estimated as $170-175K. Net yearly profit from the property (with zero cash in) is estimated as $125-lS0K.

Q. How are decisions on which property to invest into going to be made?

A. The decision will be made by company management in accordance with the proposed financial and business model. Each property will undergo detailed financial and physical due diligence to make sure it is a good fit for the Smart Oak model and purpose. The company may consider other models in a future based on the developments of business and industry trends. However, we are currently focusing on multifamily (“MF”) properties and placing them under Government Contracts or Government Programs.

An important note: all the units or partial units within the property can be rented under Governments Programs, as long as we can justify financial benefits and projected asset value increase.

Q. What are the fees that Smart Oak Corporation anticipates carrying?

A. We can identify several fees, excluding expenses, related to the administration and operation of Smart Oak in the initial phase:

- Acquisition fee (finding property, performing physical and financial due diligence, securing good loan, if any, preparing legal documents, closing the property, etc…)

- Property Management Fee (daily activities related to property operation and management: marketing, leads generations, leads conversion to tenancy, property operational processes and procedures, documentations, property repairs and managements, etc.)

- Asset Management Fees (property performance evaluation and strategies on how to value add each project, overseeing the performance of property management team and maintenance crew, financials overviews and exit strategies, etc.)

INVESTMENT

Q. How much capital is Smart Oak looking to raise?

A. Smart Oak is raising $10M in two rounds: Seed round and round A. The company is currently raising its Seed round: $3M under a $7M pre valuation. We are planning to raise an additional $7M in the round A pre valuation above $10M.

Q. What is my financial opportunity as a Smart Oak investor?

A. We expect that Smart Oak Investments market value will grow 500% in the next five years. You, as a shareholder will own part of this value. You will be also entitled to company dividends and have voting rights to elect board of directors (BOD), and accept or deny any change of control proposals when/if applicable.

Q. I am a company shareholder, and I would like to sell my shares : could I do that?

A. Smart Oak is currently a private company. Outside of several special cases, American law prohibits open market selling of private company shares. However, in some cases BOD of the company can authorize re-purchasing of your shares or transfer of their control.

Q Could the company guarantee me a certain% of dividends?

A. Although dividends can’t be guaranteed by Smart Oak, dividend payments are one of the major goals of the company. We are planning to grow our dividends to the 20% per year mark, by end of 2025. In each particular year BOD will set dividend payment and distribution based on company performance and specific market situation. One of the main principles of Smart Oak operations is complete transparency. As a shareholder you will have access to all non-confidential company information and be able to discuss these topics with BOD and corporate management.

Q. What is the Smart Oak Taxation model?

A. Initially the company will be structured as a C-corporation and later may be converted into a REIT Corporation.

As a REIT Corporation Smart Oak will pay 90% of our net profit as dividends and pay no corporate taxes.

Q. What do I own as a Smart Oak shareholder?

A. Each shareholder will own an equity piece of the company. Their ownership will be represented by company shares documented according to standard business law for the State of California.

- opportunity for investors to generate returns from all the company’s projects while only making an initial investment

- opportunity for investors to purchase additional shares while supply lasts

Q. What is the risk associated with investing in Smart Oak?

A. Smart Oak is a startup company and investing in Smart Oak is associated with significant risk.

Several risk factors are outlined below:

- Greater Oakland counties can run out of money and close all programs (highly unlikely).

- Potential market recession will make sell part of the strategy unprofitable .

- Smart Oak management would be unable to secure new deals.

- Smart Oak management will make suboptimal management decisions.

Q. What is the minimum investment amount?

A. The minimum investment amount as set by the Smart Oak BOD is $200K, but the company reserves the right to make exceptions based on special circumstances. Please contact us at info@smartoak.us for more details.

Q. Did Smart Oak founders invest in the company?

A. Yes, Smart Oak founders are invested in the company.

Q. How does Smart Oak split outstanding shares?

A. Smart Oak outstanding shares are currently split between investors and corporation (founders, BOD, BOA, employees, consultants) as 70/ 30. The company is planning to raise 2 rounds of investment with total amount of $10M : $3M in the Seed Round and $7M in round A.

Q. What is the expected ROI for Smart Oak shareholders?

A. Smart Oak shareholders return on investment (ROI) will consist of two parts: direct and indirect.

- Direct ROI will be paid in the form of dividends. Dividends will be determined annually by BOD. Dividends to be paid “pari pass u” and distributed through 1099-DIV.

- Indirect ROI is based on company capitalization increase. We expect the Smart Oak share price to grow every year.

Q. What is Smart Oak exit strategy?

A. We are planning to grow Smart Oak as a large affordable multifamily real-estate investment and operation companies. After several years of steady growth, we will explore optional exiting strategies for Smart Oak share holder s. These strategies could consist of one or more available options: selling part of the share package to the new investors for profit ; merging Smart Oak with a real-estate SPAC, M&A, conversion to a REIT, and/or taking the company public directly.

Q. How often will be dividends distributed?

A. Dividends will be distributed annually based on Board of Directors ‘ decision and in accordance with Smart Oak Corporation bylaw.

Q. Do you have any other documents related to the company that you could share?

A. We offer the following documents to prospective investors for information and review:

- Smart Oak Corporation one-pager

- Smart Oak Corporation PP presentations

- Smart Oak Corporation Financial Model

- Smart Oak Corporation sample return projection on $200K investment

- Smart Oak Corporation overview of a case study for one of our MF buildings

- Smart Oak Corporation updated Q&A

Please contact us at info@smartoak.us for more information

GENERAL

Q. Is it possible to convert a C-Corp into a REIT company? Why not create a REIT to begin with?

A. A REIT allows the company to provide 90% of dividends without paying corporate taxes. Creation of a REIT requires at least 100 shareholders. You can find more details about REITs here:

Q. Why does Smart Oak use the term “Wheel Strategy”?

A. The term “Wheel strategy” is borrowed from the financial industry. Our unique model is to use increasing property market value to “rotate the wheel” and fund new property acquisitions, and using the profit from property rent to pay corporate dividends.

Q. If some units in the property are government subsidized, what are the limitations on resale? Any constraints here?

A. There are no limitations for resale. Government subsidies guarantee rental payment and create a business opportunity for multifamily property owners, they do not create any resale contains.

Q. Is any difference between a public and private company’s dividend distribution?

A. No there is none. Same 1099-DIV.

Q. What is the sequence of further steps after the Stock Purchase Certificate is provided to the investor for signature?

A. The following is the sequence of steps:

- Investor signs and returns the Stock Purchase Agreement to the company

- Investor transfers the funds to the Company bank account

- Upon confirmation of signed agreement and funds, the company will execute the agreement, add investor into a corporate stock holding ledger, and issue a Stock Certificate under the investor’s name (which could be an individual name, a joint name, an entity name, or a Trust name) for the investor’s record and safekeeping.